Understanding 2025 Top Customs Broker Fees and Their Impact on Import Costs

As international trade continues to evolve, understanding the intricacies of customs broker fees becomes essential for businesses involved in importing goods. These fees, often perceived as an added expense, play a crucial role in facilitating smooth trade operations and ensuring compliance with government regulations. According to industry expert James Anderson, a seasoned customs brokerage consultant, "Navigating customs broker fees is not just about costs; it's about securing the future of your global supply chain."

With projected changes in 2025 impacting trade dynamics, businesses must enhance their comprehension of how customs broker fees can influence overall import costs. As more companies seek to optimize their supply chains, awareness of these fees will be integral in strategizing for effective budget management. By engaging with experienced customs brokers, importers can better navigate the complexities of fees and maximize cost efficiency in their operations, ultimately protecting their bottom line in a competitive market.

In the upcoming sections, we will delve into the various components of customs broker fees, their potential impact on total import expenses, and strategies for businesses to mitigate these costs while ensuring compliance and efficiency in their shipping processes.

Overview of Customs Broker Services and Their Role in Importing

Customs brokers play an essential role in the global trade landscape by simplifying the complexities of importing goods. They serve as intermediaries between importers and government authorities, ensuring compliance with all regulations. A customs broker's expertise includes navigating tariffs, duties, and paperwork required for the safe and legal importation of goods. This responsibility not only saves time but also helps prevent costly delays that can disrupt the supply chain.

**Tip:** When selecting a customs broker, consider their experience and specialization in your industry. A broker familiar with the specific regulations of your goods can offer valuable insights that mitigate risks and optimize your import process.

Additionally, customs brokers provide vital services such as classification of goods, valuation for customs purposes, and submission of necessary documentation. Their knowledge helps importers avoid common pitfalls, ensuring that shipments are cleared swiftly and efficiently.

**Tip:** Establish clear communication with your customs broker. Providing them with accurate information about your shipments can help streamline the process and reduce unforeseen fees that may arise due to miscommunication or misinformation.

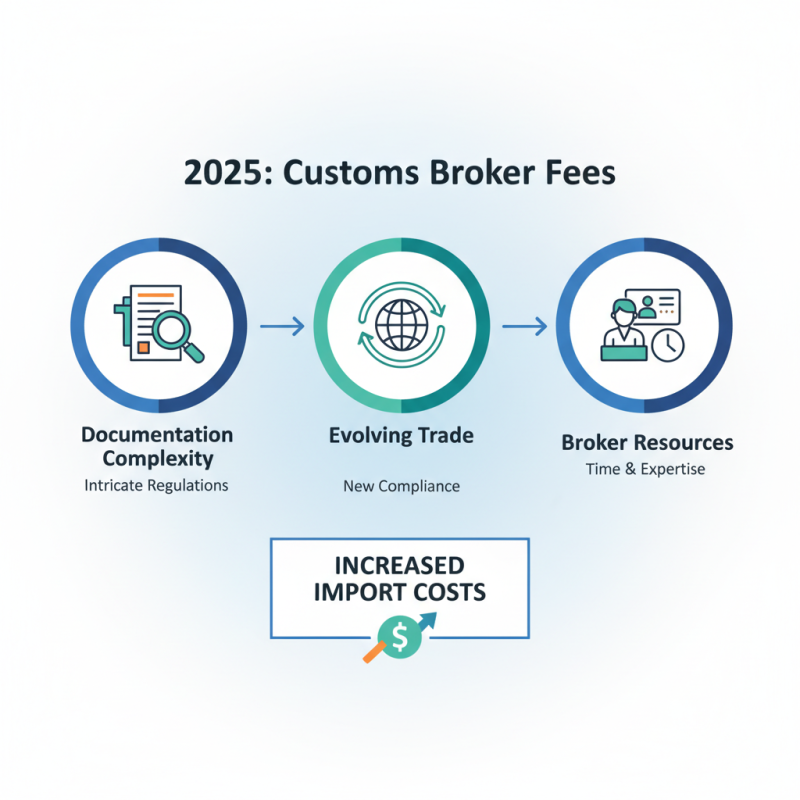

Factors Influencing Customs Broker Fees in 2025

Customs broker fees can significantly influence the overall cost of importing goods, and understanding the factors that contribute to these fees in 2025 is crucial for businesses. One primary factor is the complexity of documentation required for customs clearance; intricate regulations surrounding importing can lead to increased broker fees as they navigate these requirements on behalf of importers. As trade policies evolve and new compliance measures are introduced, customs brokers find themselves needing to invest time and resources to stay updated, which can, in turn, reflect in their pricing structures.

Additionally, the geographical location and the volume of trade play important roles in determining customs broker fees. Brokers in major ports or busy trade areas often charge higher fees due to the elevated demand for their services, while those in less trafficked locations may offer more competitive rates. Furthermore, the frequency and volume of shipments a business handles can lead to negotiated fees. Larger businesses that transport goods regularly may secure better pricing arrangements with brokers, whereas smaller importers might face higher per-shipment costs. Understanding these dynamics allows importers to make more informed financial decisions and optimize their logistics strategies in 2025.

Comparative Analysis of Customs Broker Fees Across Different Industries

Customs broker fees can vary significantly across different industries, impacting overall import costs for businesses. For instance, industries such as electronics and pharmaceuticals often face higher customs broker fees due to the complexity and regulatory scrutiny associated with their products. These sectors typically have strict compliance requirements, necessitating experienced brokers who can navigate the intricate customs procedures. As a result, companies in these industries may allocate a larger budget for customs brokerage services to ensure timely and compliant importation.

In contrast, industries such as textiles and consumer goods may enjoy relatively lower customs broker fees, as their import processes are generally less complicated. These businesses might prioritize cost efficiency, opting for brokers who offer competitive pricing. However, this cost-saving approach may come with risks, as less experienced brokers may inadvertently cause delays or compliance issues. Thus, industry-specific factors play a crucial role in determining the customs broker fees, which ultimately affect the overall cost of imports and the competitive landscape within each sector. Businesses must carefully analyze these fees in conjunction with their operational requirements to make informed decisions that align with their financial objectives.

Impact of Customs Broker Fees on Overall Import Costs for Businesses

Customs broker fees are an essential component of the overall import costs that businesses need to navigate. As companies engage in international trade, these fees can significantly affect their profit margins. Typically, customs brokers charge for their expertise in managing the complexities of customs regulations, clearing shipments, and ensuring compliance with various laws. Understanding the structure of these fees is crucial for businesses aiming to optimize their import expenses.

Furthermore, the influence of customs broker fees extends beyond just the immediate charges. These fees can lead to additional costs such as delays in shipment clearance, which might disrupt supply chains and impact inventory management. Businesses that are unaware of these potential hidden costs may find themselves facing unexpected financial burdens. Therefore, it becomes imperative for importers to evaluate brokers not only on their service fees but also on their efficiency and track record, as this can directly influence the overall cost of imports. In an ever-evolving trade environment, a thorough understanding of how customs broker fees impact total import costs is vital for maintaining competitive advantage.

Strategies to Minimize Customs Broker Fees and Optimize Import Expenses

To effectively manage customs broker fees and their influence on import expenses, businesses should adopt strategic approaches that streamline the customs process. One fundamental strategy is to establish clear communication with customs brokers to ensure all necessary documentation is in order. This proactive step can minimize delays and reduce the likelihood of additional fees associated with customs holds or requests for further information. By understanding the specific requirements related to their imports, businesses can better align their processes with the customs broker’s needs, creating a smoother transaction flow.

Another effective way to minimize customs broker fees is to consolidate shipments when possible. By grouping multiple orders into a single shipment, companies can spread the fixed costs of brokerage services over a larger volume of goods, effectively reducing the per-unit cost. Additionally, leveraging technology for compliance can help automate tedious tasks such as data entry and tracking, ultimately leading to increased accuracy and efficiency. Investing in training for staff on customs regulations and best practices can further enhance a business's ability to navigate the import process with confidence, thereby reducing reliance on broker services and associated costs.

Understanding 2025 Top Customs Broker Fees and Their Impact on Import Costs

| Customs Broker Service | Average Fee (USD) | Impact on Import Costs (%) | Strategies to Minimize Fees |

|---|---|---|---|

| Standard Customs Brokerage | $300 | 5% | Consolidate shipments |

| Electronic Filing | $150 | 2% | Use automated systems |

| Consultation Services | $200 | 3% | Regular training for staff |

| Tariff Classification | $250 | 4% | Conduct thorough product research |

| Duty Drawback Services | $350 | 6% | Implement effective tracking systems |

Related Posts

-

Top 10 Customs Broker Fees You Need to Know for Importing Goods

-

Why Truck Ka Truck Is the Best Choice for Efficient Hauling in 2023

-

10 Essential Tips for Choosing the Right Transport Broker for Your Needs

-

10 Essential Tips for Enhancing Logistics and Mobility Efficiency

-

Unlocking Logistic Transfer Innovations for Top Digital Strategies in 2025

-

How to Optimize Transportation Logistics for Efficient Supply Chain Management